Froggy Frogg / iStock via Getty Images

SkyWater Technology Overview

SkyWater Technology, Inc. (NASDAQ: SKYTPublished in April 2021, an IPO of $ 14.00 per share raised a total revenue of approximately $ 97 million.

The company is developing semiconductors Technology for the US specialty market.

I’m on hold for SKYT until the company can make a meaningful turn towards the break-even point.

Overview of SkyWater

Based in Bloomington, Minnesota, SkyWater was founded to develop and manufacture semiconductor technology certified by the US Department of Defense Defense Microelectronics Activity Category 1A.

The company was formerly part of Cypress Semiconductor, but became an independent company when it was acquired by Oxbow Industries in 2017.

The management team is headed by Thomas Sonderman, President and CEO, who has been with the company since 2017 and was previously VP and General Manager of the Integrated Solutions Group of the semiconductor company Rudolph Technologies.

The company is focused on several vertical markets.

-

Advanced calculation

-

Aerospace and defense

-

Car and transportation

-

Bio-health

-

consumer

-

Industry / Internet of Things

The company has dozens of customers pursuing through direct efforts such as Infineon (OTCQX: IFNNY) (OTCQX: IFNNF), D-Wave, L3Harris, Leonardo DRS, Microsoft, MGI and Steifpower.

SkyWater is a pure foundry that develops a variety of semiconductor technologies for a variety of end-users based in the United States, with the ability to accommodate medium-sized levels while maintaining customer development flexibility. ..

Market and competition

According to Infiniti Research’s 2019 market research report, the global market for analog and mixed signal SoCs is estimated at $ 53 billion in 2019 and is expected to reach $ 68 billion by 2023.

This represents a projected CAGR of over 6% from 2019 to 2023.

The main driver of this expected growth is the continued strong demand for SoCs across all major industries.

Also, microelectronics and adjacent technologies require greater customization that mass foundries are hesitant to do, leaving open markets for companies such as SkyWater to grow their products in these specialized markets. ..

Participants in major competitive or other industries are:

-

Taiwan TSMC

-

United Microelectronics

-

Intel

-

Vanguard Semiconductor

-

Tower semiconductor

-

XFAB Silicon Foundry

-

ONSemi

-

Globalfoundries

-

MIT Lincoln Laboratory

SkyWater’s recent financial performance

-

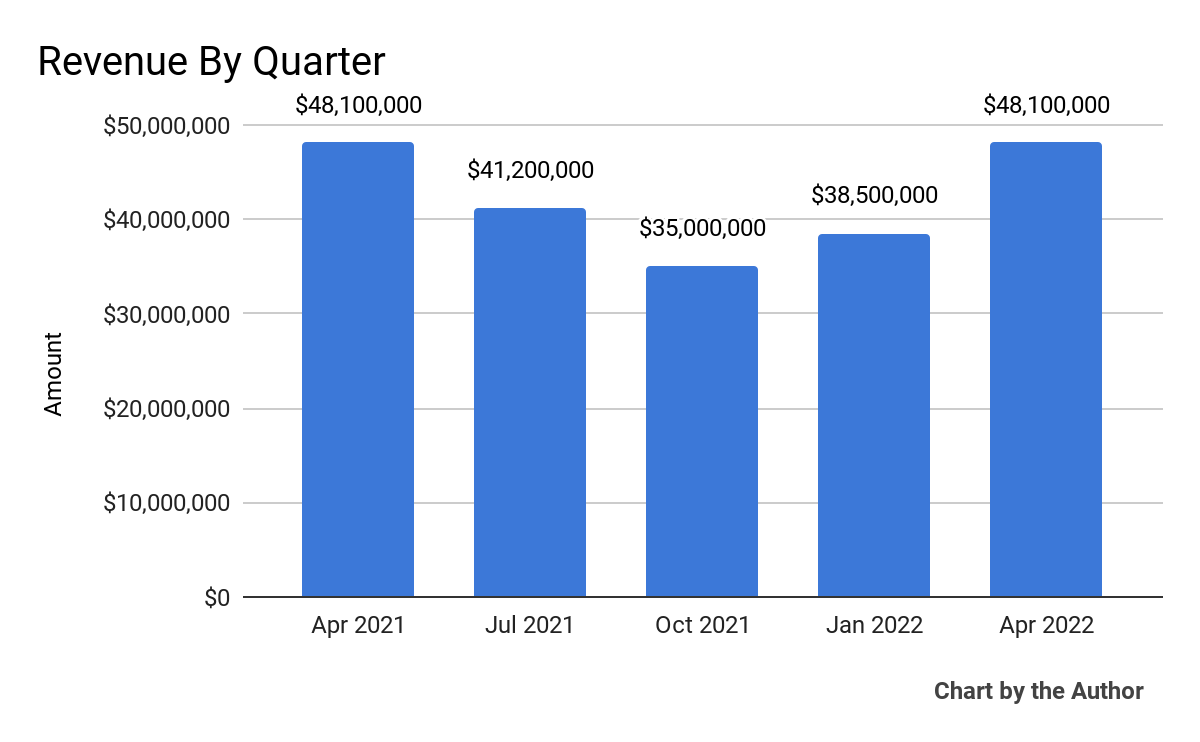

Total quarterly revenues were either down or flat year-on-year.

Total revenue for 5 quarters (In search of alpha and author)

-

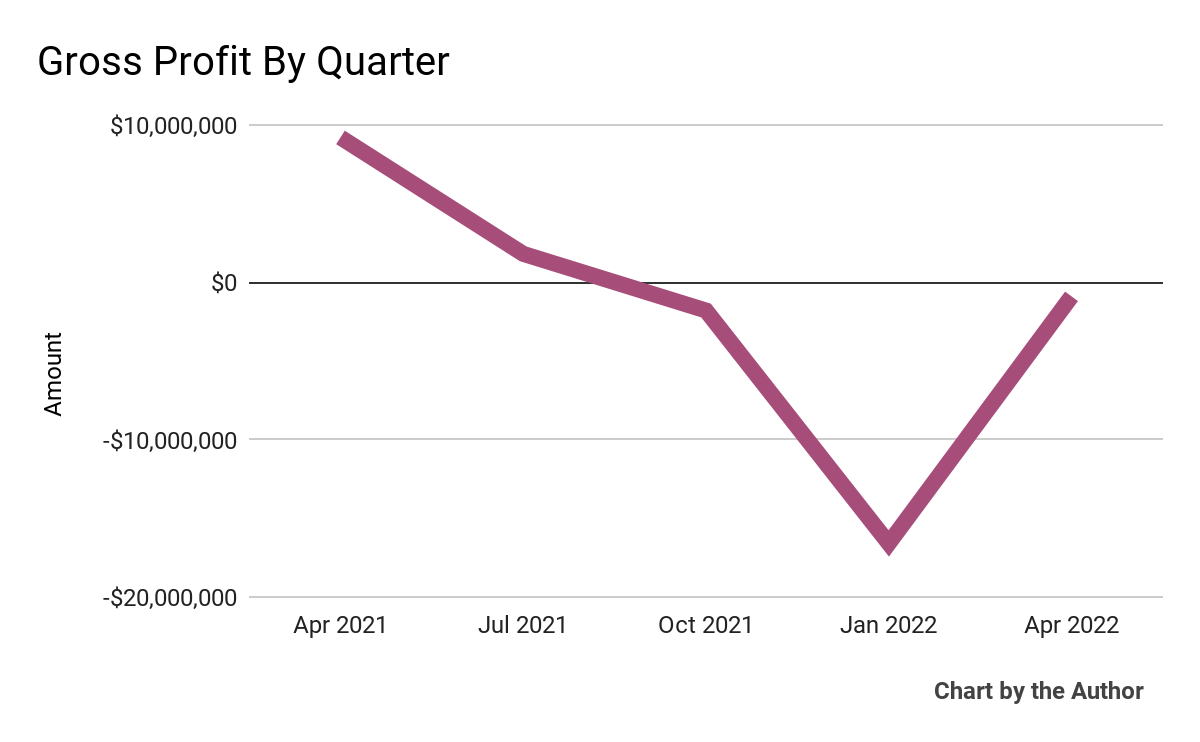

Quarterly gross profit has declined significantly over the last five quarters.

Gross profit for 5 quarters (In search of alpha and author)

-

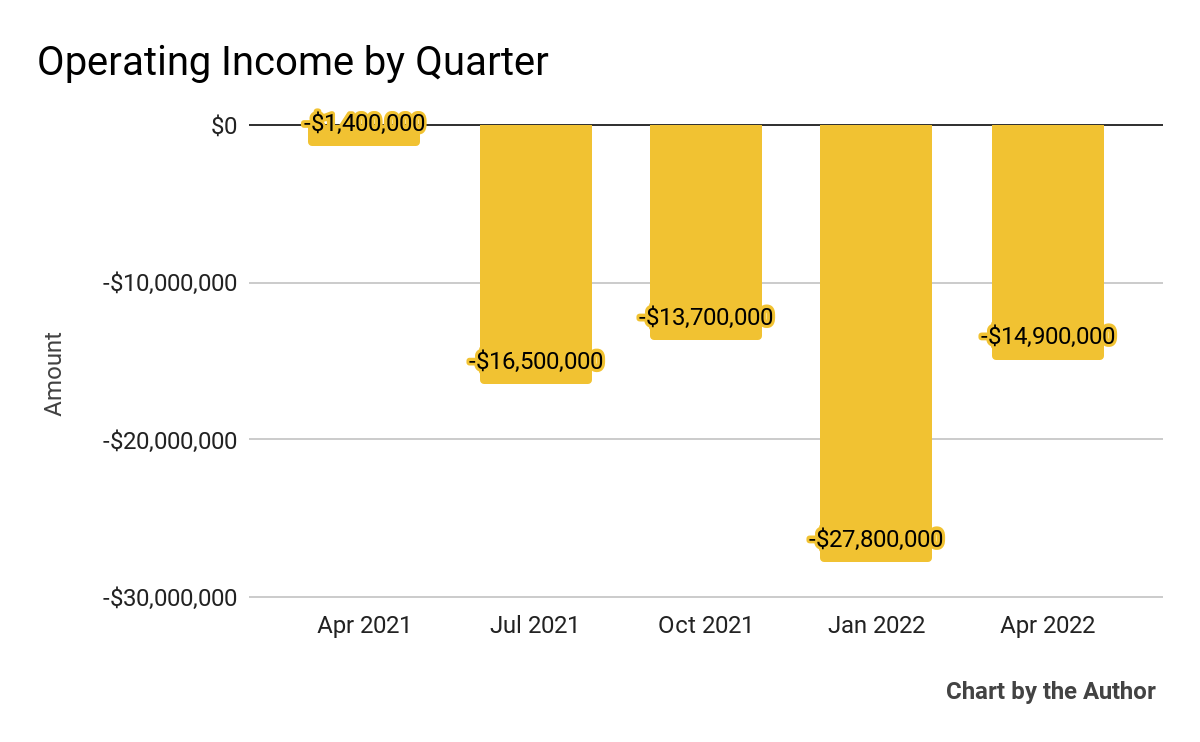

Quarterly operating profit remains significantly negative.

5 quarter operating profit (In search of alpha and author)

-

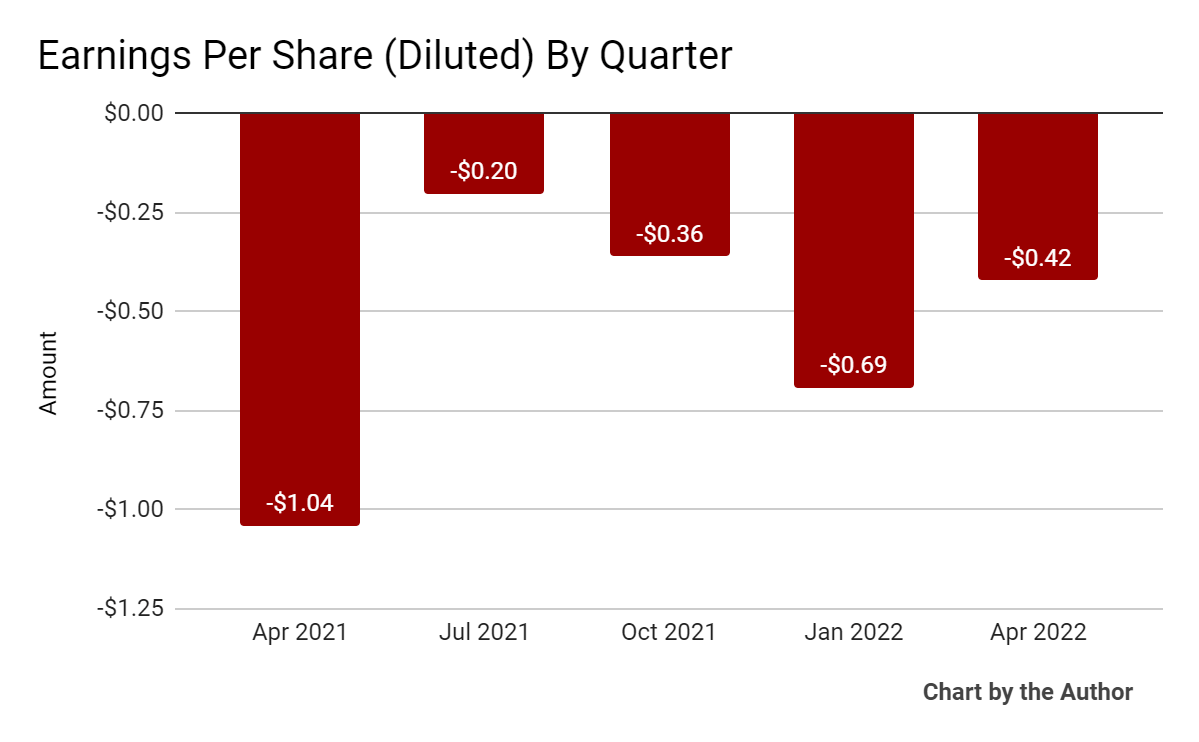

Profit per share (after dilution) is negative and there is no progress towards breakeven.

Five-quarter earnings per share (In search of alpha and author)

(Source data of GAAP financial chart above)

As the graph below shows, in the last 12 months, SKYT’s share price has fallen 74.4%, while the US S & P 500 Index has fallen 2.0%.

52-week stock price (In search of alpha)

SkyWater evaluation index

Below is a table of capitalization and valuation figures related to the company.

|

measurement |

amount |

|

Market capitalization |

$ 266,850,000 |

|

Corporate value |

$ 330,100,000 |

|

Price / Sales |

1.57 |

|

Enterprise value / sales [TTM] |

2.03 |

|

Corporate value / EBITDA [TTM] |

-7.26 |

|

Operating cash flow [TTM] |

-$ 58,050,000 |

|

Revenue growth rate [TTM] |

7.41% |

|

Profit per share |

-$ 1.67 |

(sauce)

Explanation of Sky Water

In its last earnings announcement (transcript), which covers the results of the first quarter of 2022, management highlighted price increases in key contracts with its largest customer, Infineon.

As a result, first-quarter revenues were higher than expected, but unfortunately offset by rising inventory costs.

The company aims to diversify its customer base and management believes that the new deal with Infineon is a symbol of a strategy that enhances its ability to raise prices.

The pay-as-you-go model also improves revenue visibility and smoothness, but can slow revenue growth.

In terms of financial results, first-quarter revenues were flat year-on-year, but ATS revenues and wafer service revenues continue to increase production and new customers and programs, so the 2022 revenue growth target. It is proceeding smoothly. .. “

Cost of sales increased 26%, but R & D and SG & A expenses increased year-on-year.

The company sees high costs in many categories and significant increases in labor costs as competition for shortages intensifies significantly.

Going forward, management has a variety of growth initiatives and believes that gross margins will increase as they seek to extend beyond traditional products.

In terms of valuation, the market is currently valuing SKYT at about twice the EV / multiple of revenue. This is well below the basket of listed semiconductor companies compiled by Dr. Aswath Damodaran of NYU Stern School of New York.

As of January 2022, baskets generated 8.7 times more EV / sales.

Since SKYT’s EV / revenue multiple is about 3.4 times in IPO, the company has been punished by the market since the IPO, and this valuation multiple has decreased by 41%.

A potential upside to equities is the passage of a bill that promotes (subsidizes?) Growth in the onshore semiconductor industry, but I don’t think the bill will move forward until the end of the November midterm elections.

SKYT shows the potential for increased revenue and increased visibility with a pay-as-you-go model and new growth initiatives, but rising inflation costs are still holding back and are significantly negative. increase.

I’m on hold for SKYT until the company can make a meaningful turn towards the break-even point.