pro stock studio

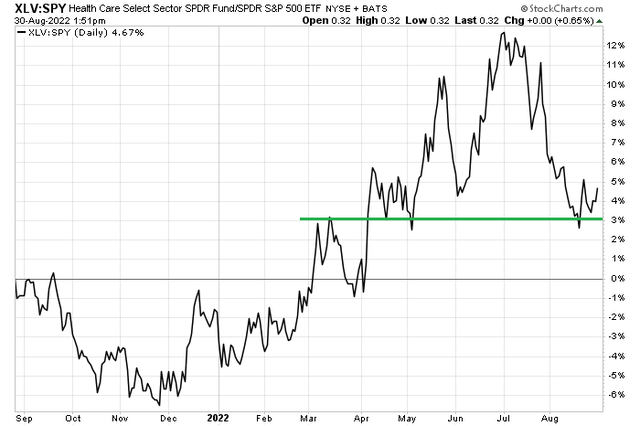

With Stock Market Volatility Rekindling, Will Healthcare Come Back Into Fashion? .for the key If the levels shown in the chart below are indeed true, active investors should consider overweighting this diverse yet defensive niche of the stock market. However, one stock, once high, is now in a significant downtrend.

Backed by the perks of the relative strengths of the healthcare sector

Stockcharts.com

According to Bank of America Global Research, Align (NASDAQ: ALGN) is the dominant player in the “clear aligner” orthodontic market, and its Invisalign brand competes with traditional metal brackets (also known as “wires and brackets”). Align’s revenues are primarily from a family of clear aligner products (cases) used to treat malocclusions (crooked teeth and other dental cosmetic and medical problems), as well as certain digital scanners, services and You get it from non-case products such as retainers. accessories.

The Arizona-based healthcare sector, a $19.4 billion healthcare equipment and supplies company, traded at a strong 12-month price-to-earnings ratio (PER) of 31.2, according to The Wall Street Journal. haven’t paid.

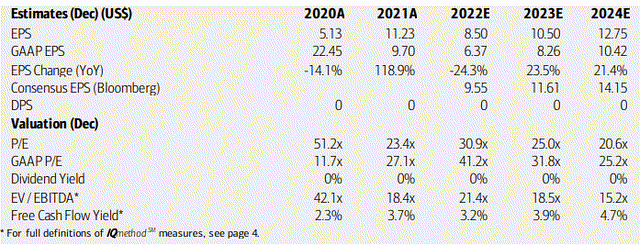

BofA analysts see a sharp decline in earnings this year ahead of a strong recovery in 2023 and continued EPS growth in 2024. In either scenario, his P/E ratio for the company looks expensive given the negative earnings growth this year compared to his 2021. Free cash flow is also modest and ALGN’s EV/EBITDA multiple is expensive.

ALGN: Earnings, Valuations, Free Cash Flow Forecasts

Stockcharts.com

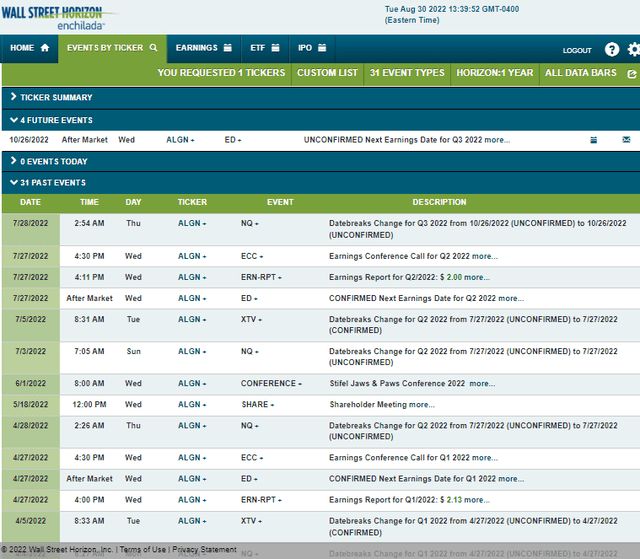

According to Wall Street Horizon, ALGN’s third quarter earnings date is unconfirmed on Wednesday, October 26th. Until then, there are no other corporate events on the docket.

Align Corporate Event Calendar

wall street horizon

technical take

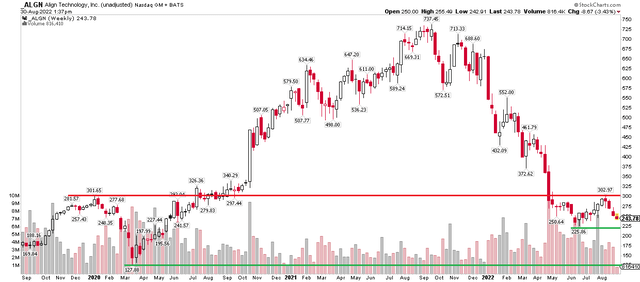

Align was very favorable through the second half of 2021 as money flowed into growth stocks, sometimes including the defensive healthcare sector. The stock has fallen 67% since last October’s high, after a series of sharp declines earlier this year. A two-month bear market rally that now looks like a classic bear flag pattern has plateaued at the crucial $300 level, with stocks down nearly 20% in recent weeks. The trend is clearly bearish.

It looks like the June low of $226 has support and is being tested based on the last 4 weeks of price action. Below that, the March 2020 bottom comes out at $128. Traders may stop below his June low, but investors should hold on given the massive and strong downtrend.

ALGN: Summer bear flag after swoop

Stockcharts.com

Conclusion

Align technology remains a strong performer, but revenue growth should improve next year and in 2024, but of course that growth will be questionable if we enter a recession. The chart doesn’t look good as the trend is going down without significant support. For healthcare exposure, look elsewhere.