art 2002

Above: A legendary venue in Manhattan that has moved many times, Madison Square Garden has its own subway station. Massive sporting events have been in its DNA for 100 years.

Madison Square Garden Entertainment Corporation (New York Stock Exchange: MSGE) (“MSG”) and its affiliates In Churchill’s words, corporations are “mysteries wrapped in enigmas.” This is because many observers can argue that live entertainment, professional sports, TV network sports, fine dining, and live theater are related businesses in that they share a common purpose. More numbers paid in discretionary income dollars from consumers.

They also share the need to present consistently compelling content that revolves around a passionate fandom related to cities with high tourist densities. Here are the tests for management: Do their locations match their products? The answer is yes. MSGE nodes are located in New York, Chicago, Las Vegas, Los Angeles, London, and Singapore. Management gets an A.

MSG

Above: The Garden is crammed with offices full of high-end information workers who fill the building, regardless of the team’s performance.

Next question: Are their products consistently attractive to markets most inclined to the ‘need to be there’ segment of the consumer sector? Again, the post-pandemic consumer world Depending on how you look at it, the answer is yes.

But the final question that investors care about the most is: How can all of this be judged in order to determine value?

Mr. Market has allocated a market capitalization of $2.22 billion to the company. At the same time, MSG’s most valuable assets, and essentially unconsidered, are his two professional sports teams owned by James L. Dolan: the New York NBA Knicks and the New York NHL Rangers.

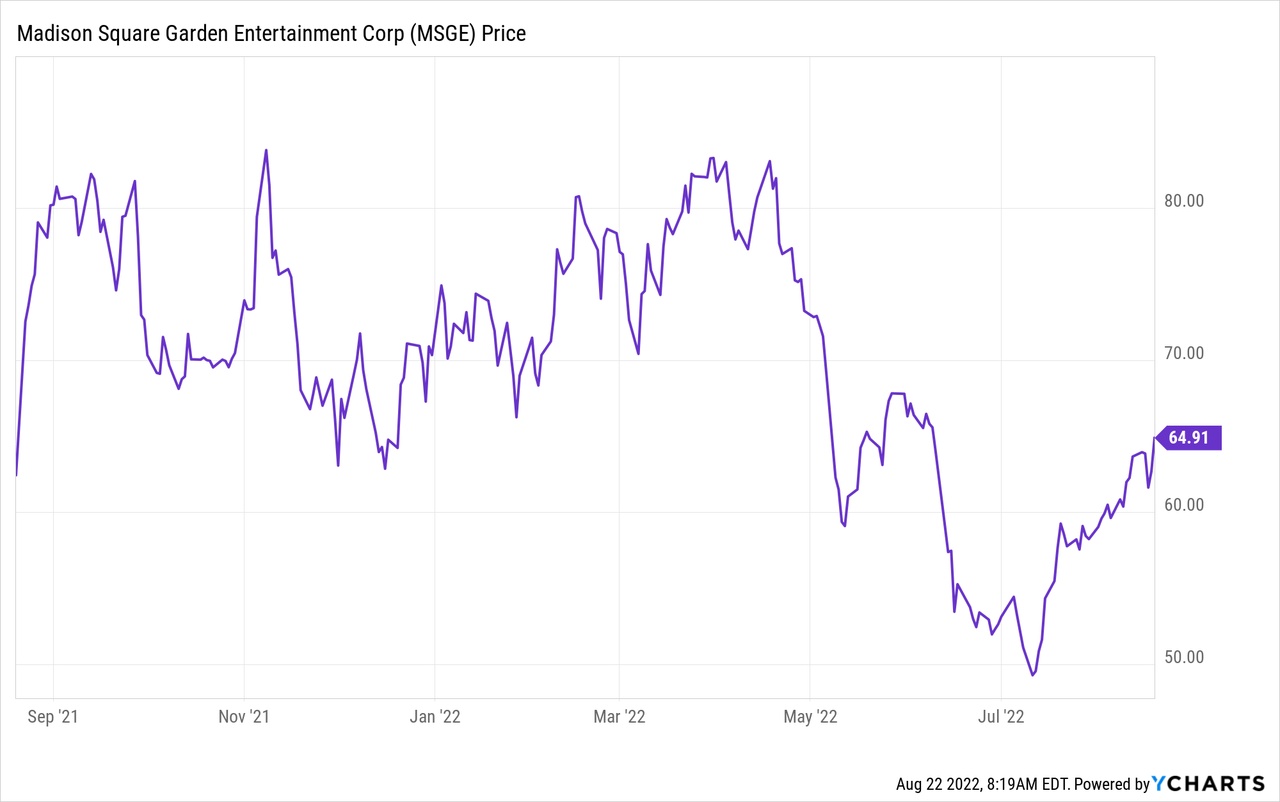

Price at time of writing:

Madison Square Garden Entertainment Corporation (MSGE): $64.9

Madison Square Garden Sports Corporation (MSGS): $173.86

My buy signal is on MSGE. This is because the asset-based price seems to be more attractive to steam heads post-IPO, as Sphere received rave reviews early in its life. This will increase your interest in the stock.

With all the current asset value hidden within the team and the revenue it reliably generates, the heavyweight new MSGS seems to be slowing down in a market that has become heavily dependent on what-if news streams. It seems to me. It’s a clear “it depends” issue after the pandemic.

According to Forbes’ latest estimates, the Knicks are worth $5.5 billion and the Rangers at $2.2 billion, putting together a very small theoretical package of $7.7 billion, more than triple MSGE’s valuation. . The Knicks make him $300 million and the Rangers he makes $95 million. Both franchises are profitable, and Home He benefits from the one-of-a-kind value of Madison Square Garden, where he plays his games. Here are the most interesting things about both teams: In good or bad seasons, live gates are always sold out and every match reflects the rabid fandom in the area.

Add to that a short footprint from Manhattan’s high-end working masses, whose games present business/social events above all else, and you have real sit-down cute status. .

But none of this is reflected in the equity value of MSGE, which is essentially the corporate landlord of both teams. The team itself is owned by MSG Sports Corporation’s James L. Dolan and is now clearly understood but has no intention of selling.

And who can blame him? So the value of these two professional sports assets lies primarily in the MSGE TV network’s business of broadcasting the games. And it’s all about ratings and advertising, the products sold in the garden, etc.

(The value of the team is owned by Dolan (71%) as part of Madison Square Garden Sports Corporation (MSGS), whose shares trade at $173 a share).

So for MSGE, let’s divide the business as follows:

Madison Square Garden: It is no exaggeration to say that the Garden is a global sports mecca. Its legacy runs deep through the decades as home to his famous boxing championships, professional and college sports, and later in concerts. It’s no coincidence that Billy Joel has made The Garden the home of multiple appearances in his Twilight career.

The question here is whether the goal of dividing the garden is to accelerate the revenue stream that greatly increases its value. The answer is probably no. The possibilities are undeniable.

An underperforming NY Knicks NBA team could get a vitamin shot out of the draft or find a top free agent and make the playoffs. This could quickly translate into playoff live attendance and TV dollar bonuses. But that is only a possibility, and far from reality at this point. The NHL Rangers made a valiant sting with their championship shot, blowing away excess cash and making a profit.

Live attendance at MSGE venues such as Radio City Musical Hall, NY Beacon Theatre, Chicago Theater and Radio City’s Christmas Spectacular (expanding to full capacity this year) continues with live attendance during the slow start of covid-19 bring great benefits to the , but a stop-start fade in the minds of theater goers?

So far, MSGE’s 2022 figures show bodies are beginning to recover in healthy numbers. There is clearly potential demand among a segment of the public where rising ticket prices are not a major barrier. So it’s clear that we can be optimistic about the earning power of these venues going forward.

Tao Group: Simply put, these are 70 destination-type eateries in New York, Las Vegas, Chicago, Los Angeles, London, and Singapore. These aren’t the type of eateries that just spread tables and chairs out on the sidewalk. And will people who feel safe in their homes continue to eat at restaurants with insanely inflated menus?

Or will the forming recessionary trend hit places like Tao first? Tao’s business value will clearly be challenged by the extent to which tourism revives. There are many positive signs in Las Vegas. This is obviously the time to roll the dice.

sphere is a ball game

Below: The giant Orb will hold 20,000 people when it opens late next year and will redefine the entertainment experience in Las Vegas.

MSG

A major challenge in MSGE’s management and asset allocation decisions is the placement of 20,000 360-degree giant viewing venues adjacent to the Las Vegas Venetian Hotel. A giant orb with state-of-the-art entertainment tech that makes your pals look a bit like Nickelodeon, the $2 billion investment is certainly in the right place. The state of the public attendance business when it opens later next year is less certain.

That’s the big bet. First, there is no shortage of seats in Las Vegas entertainment venues. And filling what is already in place still requires massive marketing by top-tier casino operators through tens of millions of rewards memberships to drive attendance. We speculate that they have a deal to work with and gain millions of members.

Historically, Las Vegas has had two types of entertainment. I’ve been there and done that in my own casino management days and it’s not easy. Little has changed since then. As usual, it is the gravitational pull of the stars that produces the body. Unless there is a huge international fan base for an act of existing demo-collection, you are doomed.

Or you want a jaw dropper as we once called it, a spectacle that evokes the “wow” factor. Among them were, by way of example, the great Siegfried and Roy of the Mirage (who, in my time, performed the magic deeds of David Copperfield).

For all its techno spectacle, amazing immersion in a new world of body-generating power, The Sphere opens to real jaw-droppers to step firmly into the Las Vegas tourist sky. Must be… The location is great. Its design is definitely one-of-a-kind. Above all, what investors need to know most is what the first year of programming has to offer and Vegas has yet to see. It’s that simple.

MSG Networks

A regional sports network whose primary content is professional team games, interspersed with high-profile college games, clearly relies on ratings and surrounding content for sports programming. Both the NBA and NHL team fandoms don’t grow quickly. If anything, one of the challenges ahead for both leagues is cultivating a new fandom from younger generations addicted to homemade social media tropes. Still, the current level of fandom for both the Knicks and the Rangers is solid, perhaps a bit decrepit, but saying it’s viable in terms of supporting viewing on the MSG network It is no exaggeration to say that

That is, sports fans, concert-goers, tourists and TV viewers are thrown together as the core customer base for the two newly formed public companies presented to investors. Their commonality of purpose makes some sense. The ongoing hope is that they will benefit substantially from the return to live entertainment and dining experiences post-pandemic, generating returns that will please investors.

Their challenge is a lack of defense, so to speak, against the shaping recession, rising prices due to ongoing inflationary pressures, and the extent of lingering fear in many demographic segments visiting indoor spaces with large crowds. is in

MSG Networks alone cannot carry the revenue and EBITDA load for the new company. Tao Group is battling on many fronts, including rising menu prices, tourist numbers, and a growing sense of satisfaction with takeout deliveries.

But overall, there’s a consistency that isn’t obvious to investors in the current structure. The outlook for all components hinges on the prospect of recovery in consumer discretionary spending, such as entertainment participation and dining in tourist cities.

So, in the event of a possible split, you will own one company consisting of The Sphere and Tao Group, and another company will own the gardens, theaters and networks. No matter how you rate this as his two unique offerings to investors, it comes down to a positive outlook in our view. In other words, both companies must prove their worth without crutches from the other’s business.

And it will be much easier to understand and evaluate.

Once these assets are separated, I think we’ll have a clearer way of evaluating them that will depend entirely on what the world of consumer autonomy looks like in the next three to five years.

Current company:

2022 (June) TTM

Revenue: $1.7 billion of all units merged and absorbed.

Operating (Loss) $102.7M

ADJ Op. Revenue: $133 million VS. 2021 ($188.2 million)

By segment:

Live venues: $655 million.

MSG Network: $608 million.

Tao Group: $484.9 million

Other: ($23.9 million).

The clarity of the split we see is: The spun-off Tao Group is linked to the upcoming Sphere revenue and probably won’t become a fully functioning revenue stream until the 2023 fiscal year of June 2023. Investors are betting on a strong recovery in tourism, as much depends on the location and attractiveness of the destination.

The MSG Sports Group will continue to benefit from robust sports and theater business, the MSG network and the iconic brand value of Madison Square Garden, a landmark in those arenas.

One apparently built out of sports and live participation, the other related to the tourist business with dining and grand theatres.

So instead of a bag of diamonds that most people don’t see, a diamond necklace and a bracelet are the complementary settings. A post-pandemic world sets the price per carat.