Markets have been volatile in August, and the summer rally has stalled over the past week. We see a return to the themes seen earlier this year, with defensive sectors outperforming while technology and growth lead the downside. Bond yields have surged, but energy stocks have held up after setbacks earlier in the summer.

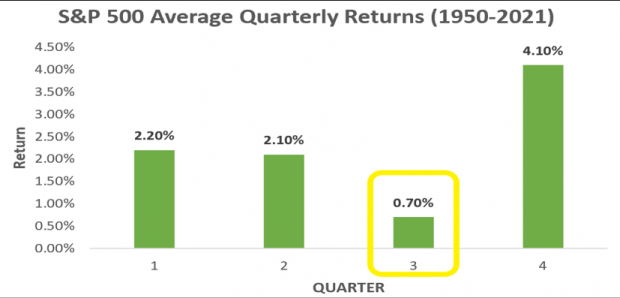

We also head into September, the dreaded month that was the worst month in the interim year going back to 1928 (averaging -1.14%). The average going back to 1950 is just 0.7%. The combination of unfavorable seasonality and overall volatility in the middle of the year could cause problems in the weeks and months that follow.

Image Source: Sachs Investment Research

That’s why it’s so important to be very careful with individual stock purchases and only target the strongest stocks in the strongest uptrend. Identifying key stocks can help you navigate volatility and include stocks with the highest profit potential. In this perilous market environment, let’s take a look at the best-valued stocks defying the odds to hit 52-week highs.

A Zacks Rank #1 (strong buy) stock

World Wrestling Entertainment WWE is an integrated media and entertainment company. WWE is committed to producing and monetizing video content across a variety of platforms including WWE Network, broadcast and pay TV, digital and social media. Live events generate revenue through the sale of tickets and travel packages. World Wrestling Entertainment also commercializes branded products such as video games, toys, apparel and books.

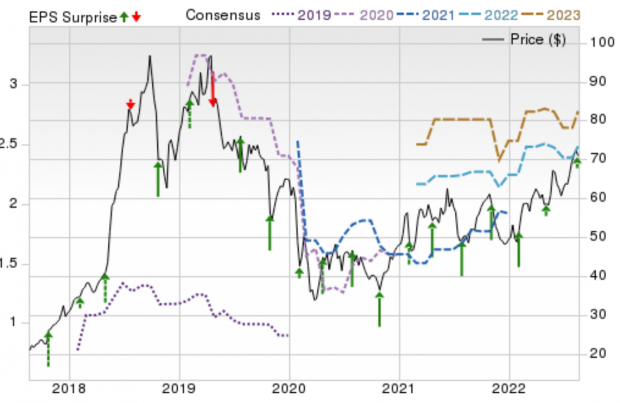

WWE has beaten earnings projections in each of the last four quarters. The global media giant last week announced his EPS for the second quarter at $0.59 per share. He is 5.36% above the consensus expectation of $0.56. WWE posted a staggering 30.93% return on his four-quarter average, boosting the stock price by more than 45% over the past year.

Image Source: Sachs Investment Research

Analysts have agreed on earnings revisions and are raising estimates across the board. His EPS estimate for the full year over the last 60 days he increased by 4.18%. The Zacks Consensus Estimate is now $2.49 per share, reflecting potential growth of 17.45% year-over-year. Sales he is expected to grow 18.61% to his $1.3 billion.

Employing a process to identify leading stocks helps investors navigate this market. Heading into a historically weak third quarter, keep an eye on WWE.

Infrastructure stock boom swept America

A massive push to rebuild America’s crumbling infrastructure is soon underway. It’s bipartisan, urgent, and inevitable. It costs trillions. Good luck is made.

The only question is, “Can I get the right stocks early, when the growth potential is greatest?”

Zacks released a special report to help you do just that. It’s free today. From building and repairing roads, bridges and buildings, to freight transportation and energy conversion on an almost unimaginable scale, discover five extraordinary businesses looking to maximize their profits.

Want the latest recommendations from Zacks Investment Research? You can download the 7 Best Stocks for the Next 30 Days today.Click to get this free report

World Wrestling Entertainment, Inc. (WWE): Free Stock Analysis Report

Click here to read this article on Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the authors and do not necessarily reflect those of Nasdaq, Inc.